In the world of digital commerce, the best payment experiences are often the ones you don’t even notice. Invisible payments are transforming the way we interact with money, making transactions seamless, secure, and effortless. As consumer expectations evolve, businesses that embrace invisible payments are setting a new standard for convenience and loyalty.In this blog, we’ll …

Invisible Payments, Visible Impact: The Seamless Future of Commerce

Payments in the Channel

In the world of digital commerce, the best payment experiences are often the ones you don’t even notice. Invisible payments are transforming the way we interact with money, making transactions seamless, secure, and effortless. As consumer expectations evolve, businesses that embrace invisible payments are setting a new standard for convenience and loyalty.

In this blog, we’ll explore the concept of invisible payments, their benefits, how they work, and how they’re shaping the future of commerce.

What Are Invisible Payments?

Invisible payments are transactions that occur in the background, without requiring any active input from the customer at the point of sale. This means:

- No checkout process

- No entering of payment details

- No manual confirmation

The goal is to make the payment process so seamless that it becomes virtually invisible to the user—just like how Uber charges your card when you step out of the car, or how Amazon Go lets you walk out of a store without scanning a single item.

According to Accenture, 75% of consumers say they are more likely to shop with a brand that offers a seamless payment experience.

The Benefits of Invisible Payments

1. Enhanced Customer Experience

Invisible payments eliminate friction. Customers don’t have to fumble with wallets, cards, or apps. The result is:

- Faster checkouts

- Less cognitive load

- A more enjoyable shopping experience

A smoother payment experience can increase customer satisfaction and brand loyalty.

2. Increased Conversion Rates

Every extra step in a checkout process is a potential drop-off point. Invisible payments reduce these steps to zero, leading to:

- Lower cart abandonment

- Higher conversion rates

- More completed transactions

3. Convenience and Speed

Invisible payments offer unparalleled convenience. Whether it’s a subscription renewal, a ride-share, or a smart device reordering supplies, the transaction happens automatically—saving time and effort for the customer.

How Invisible Payments Work

Invisible payments rely on a combination of technologies that work together to authenticate users, authorise transactions, and ensure security—all without interrupting the user experience.

1. Tokenisation

Tokenisation replaces sensitive payment information (like card numbers) with a secure, unique identifier or “token.” This allows for:

- One-click or zero-click payments

- Secure storage of payment credentials

- Reduced PCI compliance burden

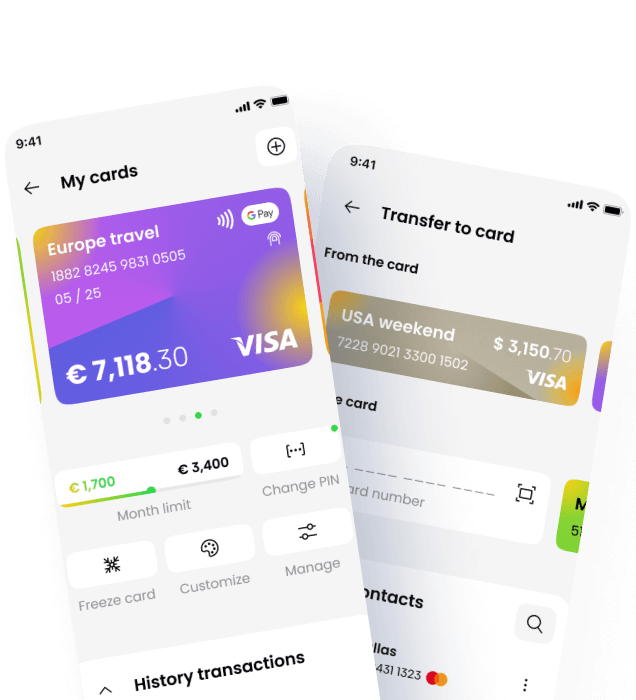

2. Mobile Wallets

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay enable invisible payments through:

- Biometric authentication (face or fingerprint)

- Tap-to-pay functionality

- Background authorisation for in-app purchases

3. Subscription Models

Recurring billing is a form of invisible payment. Once a customer subscribes, payments are processed automatically at regular intervals—no action required.

This model is widely used in SaaS, streaming services, and digital memberships.

Real-World Examples

Amazon Go

Amazon Go stores use a combination of computer vision, sensors, and AI to track what customers pick up. When they leave the store, their Amazon account is automatically charged—no checkout required.

Uber

Uber pioneered invisible payments in the ride-sharing space. Riders simply enter and exit the vehicle, and the fare is charged automatically in the background.

Starbucks App

Starbucks allows customers to order and pay in advance via its app. The payment is processed invisibly, and the customer simply picks up their drink—no waiting in line or handling cash.

The Future of Invisible Payments

As technology continues to evolve, invisible payments will become even more integrated into our daily lives. Key trends include:

Internet of Things (IoT)

Smart devices will initiate and complete payments autonomously. Imagine:

- A smart fridge that orders and pays for groceries when supplies run low

- A connected car that pays for tolls, fuel, or parking automatically

Voice Commerce

Voice assistants like Alexa and Google Assistant will enable hands-free purchases. “Alexa, reorder dog food” becomes a voice-activated, invisible transaction.

AI-Powered Personalisation

AI will use payment data to anticipate needs and automate purchases—like renewing a subscription before it expires or suggesting a refill based on usage patterns.

Security and Trust

Invisible doesn’t mean insecure. In fact, invisible payments often rely on:

- Biometric authentication

- Device fingerprinting

- Real-time fraud detection

- Tokenisation and encryption

Trust is critical. Businesses must ensure that invisible payments are not only seamless but also secure and transparent.

Conclusion

Invisible payments are not just a trend—they’re the future of commerce. By removing barriers and making transactions seamless, businesses can:

- Enhance customer satisfaction

- Increase conversion rates

- Gain a competitive edge

At Payments in the Channel, we’re committed to helping businesses implement invisible payment solutions that drive growth and success. Whether you’re a SaaS provider, retailer, or digital platform, now is the time to embrace the invisible.