In today's fast-paced business environment, providing a seamless and efficient payment experience is crucial for closing deals and driving revenue. Payment links offer a simple and effective way to streamline the quote-to-cash process. This blog explores how payment links work, their benefits, and how they can enhance the sales process—especially for SaaS providers, B2B service …

Payments in the Channel

In today’s fast-paced business environment, providing a seamless and efficient payment experience is crucial for closing deals and driving revenue. Payment links offer a simple and effective way to streamline the quote-to-cash process. This blog explores how payment links work, their benefits, and how they can enhance the sales process—especially for SaaS providers, B2B service companies, and technology resellers.

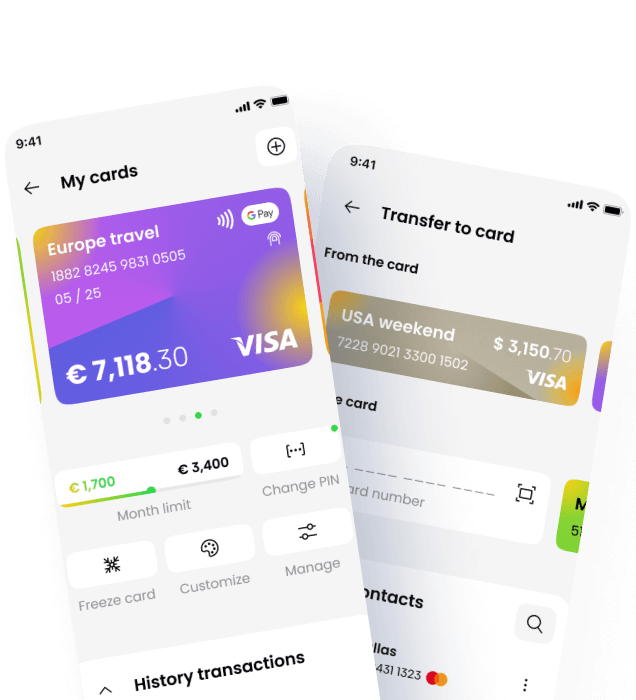

What Are Payment Links?

Payment links are unique, secure URLs that businesses can generate and send to customers to facilitate online payments. These links can be embedded in quotes, invoices, emails, or even text messages, allowing customers to make payments quickly and easily—without needing to log into a portal or navigate a checkout page.

They are especially useful in B2B sales environments where deals are often closed via email or over the phone, and where speed and simplicity can make or break a transaction.

Benefits of Payment Links

Convenience

Customers can pay with just a few clicks—no need to navigate a website or manually enter payment details. This is particularly valuable in B2B sales, where decision-makers are often busy and appreciate frictionless experiences.

Speed

Payment links accelerate the payment process. Instead of waiting for a manual invoice or bank transfer, customers can pay instantly, reducing the time it takes to close deals and receive funds.

Flexibility

Payment links can be configured for one-time payments, recurring subscriptions, or installment plans. This flexibility supports a wide range of business models, from SaaS to hardware leasing.

Security

Modern payment links are encrypted and PCI-compliant, ensuring that customer payment information is protected. Many platforms also support tokenisation and 3D Secure for added fraud protection.

How Payment Links Enhance the Quote Process

1. Simplified Payment Collection

Including a payment link in a quote or invoice allows customers to pay immediately upon receiving the document. This eliminates the need for manual follow-up and reduces the risk of delayed payments.

Example: A managed service provider (MSP) includes a payment link in their emailed quote. The client clicks, pays, and the service is activated within minutes—no back-and-forth required.

2. Improved Cash Flow

Faster payments mean better cash flow. For small businesses and startups, this can be the difference between scaling and stalling. Payment links reduce the average days sales outstanding (DSO), helping businesses maintain healthy liquidity.

3. Enhanced Customer Experience

A seamless payment experience builds trust and satisfaction. When customers can pay easily and securely, they’re more likely to return and recommend your services.

4. Reduced Administrative Burden

Automating the payment collection process with payment links reduces the workload on sales and finance teams. No more chasing invoices or manually reconciling payments—everything is tracked and logged automatically.

Use Cases for Payment Links

- Quotes and Invoices: Embed payment links directly into digital quotes or invoices to enable instant payment.

- Email Campaigns: Use payment links in renewal or upsell campaigns to drive conversions.

- Text Messages: Send payment links via SMS for on-the-go convenience, especially for field service or mobile sales teams.

- Recurring Payments: Set up recurring payment links for subscription services, maintenance contracts, or installment plans.

Best Practices for Using Payment Links

- Use branded payment pages to maintain trust and consistency.

- Include a clear description of what the payment is for.

- Set expiration dates for time-sensitive quotes or offers.

- Enable notifications for both the customer and your team when a payment is completed.

- Integrate with your CRM or ERP to automatically update records and trigger workflows.

Real-World Example: SaaS Company Streamlines Onboarding

A SaaS company offering project management tools used to send PDF quotes and wait for manual bank transfers. By switching to payment links embedded in their quotes, they reduced onboarding time from 3 days to under 24 hours. Customers could pay instantly, triggering automated account setup and welcome emails—creating a smoother, faster experience.

Conclusion

Payment links are a powerful tool for streamlining the quote-to-cash process and enhancing the customer experience. By providing a convenient, secure, and flexible payment option, businesses can accelerate the payment process, improve cash flow, and reduce administrative burdens.

Whether you’re a SaaS provider, MSP, VAR, or B2B service business, integrating payment links into your sales process can help you close deals faster and serve your customers better.

🔗 Learn more at (https://www.paymentsinthechannel.com)