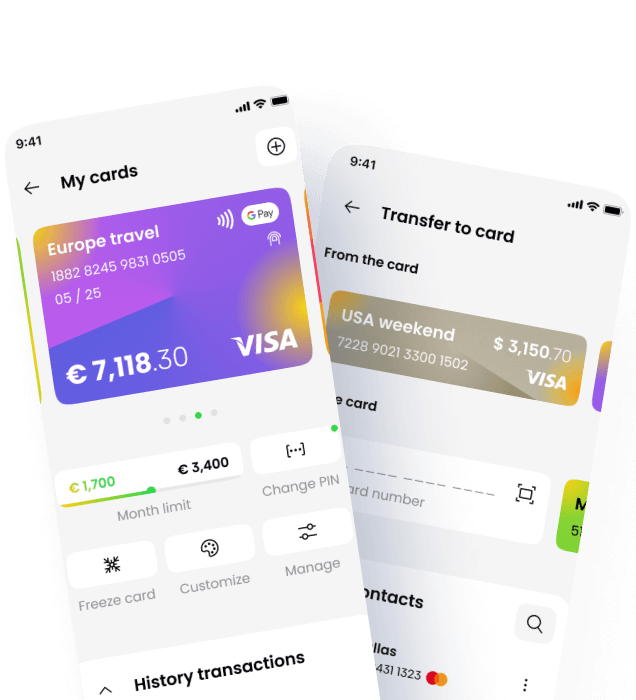

In today’s digital-first economy, online payment processing is no longer a luxury—it’s a necessity. Whether you're a small business owner launching your first e-commerce store or a seasoned enterprise expanding into new markets, understanding how online payments work is essential to delivering a seamless customer experience and ensuring secure, efficient transactions.This guide breaks down the …

Blog Page

Welcome to the Payments in the Channel Blog — your go-to source for insights, trends, and expert commentary on the evolving world of payments across the UK and beyond. Whether you’re a fintech innovator, a channel partner, or simply curious about how payments are transforming commerce, our blog delivers timely analysis, thought leadership, and practical guidance. From regulatory updates and digital payment innovations to partner strategies and market shifts, we cover the topics that matter most to the payments ecosystem. Stay informed, stay ahead.

As businesses expand across borders, one of the most critical decisions they face is how to manage payments in international markets. Two models dominate the conversation: Merchant of Record (MoR) and Local Acquiring. Each offers distinct advantages—and potential pitfalls—depending on your business model, risk appetite, and growth strategy. In this blog, we’ll break down what …

In the world of digital commerce, the best payment experiences are often the ones you don’t even notice. Invisible payments are transforming the way we interact with money, making transactions seamless, secure, and effortless. As consumer expectations evolve, businesses that embrace invisible payments are setting a new standard for convenience and loyalty.In this blog, we’ll …

In today’s digital economy, data is often considered more valuable than money. Every transaction generates a wealth of information that can be used to gain insights, improve services, and drive business growth. For businesses that process payments—especially SaaS providers, e-commerce platforms, and fintech companies—payment data is a goldmine waiting to be tapped.In this blog, we’ll …

Fraudsters are no longer lone hackers operating in the shadows—they’re organized, AI-powered, and fast. As digital payments become more seamless and real-time, so too do the threats that accompany them. Businesses must evolve their defences to stay ahead of increasingly sophisticated fraud tactics.In this blog, we explore the emerging threats in payment fraud, the technologies …

In the world of payments, the best experience is often the one you don’t even notice. Frictionless payments are becoming the gold standard, offering seamless transactions that enhance customer satisfaction and drive business growth. As digital commerce continues to evolve, businesses that prioritise ease and speed at checkout are gaining a competitive edge.In this blog, …

Recurring payments are a cornerstone of the subscription economy, providing businesses with a steady stream of revenue. However, managing recurring payments can be challenging, with risks such as payment failures, churn, and fraud. This blog explores strategies to make recurring payments profitable and risk-free.The Importance of Recurring PaymentsRecurring payments offer several benefits for businesses:Industry InsightsAccording …

In today's fast-paced business environment, providing a seamless and efficient payment experience is crucial for closing deals and driving revenue. Payment links offer a simple and effective way to streamline the quote-to-cash process. This blog explores how payment links work, their benefits, and how they can enhance the sales process—especially for SaaS providers, B2B service …

Independent Software Vendors (ISVs) often view payment processing as a necessary but costly part of their business. However, with the right strategies, ISVs can transform payments from a cost center into a profit center. This blog explores how ISVs can leverage payment processing to drive revenue and growth.The Traditional View of PaymentsFor many ISVs, payment …

Open Banking is revolutionising the financial industry by enabling secure and seamless access to financial data. This innovative approach allows customers to share their financial information with third-party providers, leading to enhanced services and improved customer experiences.Understanding Open BankingOpen Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure exchange of financial …

Open Banking is revolutionising the way we manage and access financial data. One of the most exciting developments in this space is the integration of Open Banking with payment terminals, enabling seamless and secure transactions directly from bank accounts.What is Open Banking?Open Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure …

In the world of payments, integration is key to providing a seamless and efficient experience for both businesses and customers. At Payments in the Channel, we understand the importance of integrating with various platforms and services to enhance functionality and streamline processes.Payment Gateways?We integrate with leading payment gateways to ensure secure and efficient transaction processing. Some …

In today's globalised economy, businesses are increasingly selling products and services across international borders. While this opens up new revenue streams, it also introduces complexities in managing international sales tax. Avalara, a leading provider of tax compliance solutions, offers tools to simplify this process and ensure businesses charge the correct sales tax on their checkout.The …

In today’s globalised economy, businesses are increasingly selling products and services across borders. While this opens up exciting new revenue streams, it also introduces a complex web of tax obligations—especially in the United States, where sales tax rules vary not just by state, but often by city and county.For businesses operating online, ensuring that the …

The Merchant of Record (MoR) model has long been the go-to solution for businesses expanding internationally. It offers a convenient, all-in-one approach to handling payments, compliance, tax, and risk. But as global commerce matures, a new trend is emerging: unbundling the MoR.Rather than relying on a single provider to manage everything, businesses are increasingly choosing to modularisetheir payment stack—selecting …

In today’s digital-first economy, online payment processing is no longer a luxury—it’s a necessity. Whether you're a small business owner launching your first e-commerce store or a seasoned enterprise expanding into new markets, understanding how online payments work is essential to delivering a seamless customer experience and ensuring secure, efficient transactions.This guide breaks down the …