In today’s digital economy, data is often considered more valuable than money. Every transaction generates a wealth of information that can be used to gain insights, improve services, and drive business growth. For businesses that process payments—especially SaaS providers, e-commerce platforms, and fintech companies—payment data is a goldmine waiting to be tapped.In this blog, we’ll …

Data is the New Currency: Unlocking the Power of Payment Intelligence

Payments in the Channel

In today’s digital economy, data is often considered more valuable than money. Every transaction generates a wealth of information that can be used to gain insights, improve services, and drive business growth. For businesses that process payments—especially SaaS providers, e-commerce platforms, and fintech companies—payment data is a goldmine waiting to be tapped.

In this blog, we’ll explore how payment data can be leveraged to unlock new opportunities and why it’s becoming the new currency of the digital age.

The Value of Payment Data

Payment data is more than just a record of who paid what and when. It’s a real-time reflection of customer behaviour, operational performance, and financial health. Here’s how it can be used:

1. Customer Insights

Payment data reveals:

- What customers are buying

- How often they purchase

- Which payment methods they prefer

- What time of day or week they transact

By analysing this data, businesses can:

- Segment customers by behaviour

- Identify high-value or at-risk customers

- Tailor marketing campaigns and product recommendations

Example: A SaaS company notices that customers who pay annually have a 40% higher retention rate than monthly subscribers. They use this insight to promote annual plans more aggressively.

2. Fraud Detection

Payment data is a frontline defence against fraud. By analysing transaction patterns, businesses can:

- Detect anomalies (e.g., sudden high-value purchases, unusual geolocations)

- Flag suspicious behavior in real-time

- Reduce chargebacks and financial losses

Machine learning models can be trained on historical payment data to predict and prevent fraud before it happens.

PayPal uses real-time payment data and machine learning to detect fraudulent activity, protecting millions of users globally.

3. Operational Efficiency

Payment data can highlight inefficiencies in your billing and checkout processes:

- High decline rates may indicate outdated card data or poor gateway performance

- Long transaction times may frustrate customers and reduce conversions

- Refund and dispute trends can reveal product or service issues

By identifying and addressing these issues, businesses can streamline operations and improve the customer experience.

How to Leverage Payment Data

To unlock the full value of payment data, businesses need the right tools and strategies:

1. Data Analytics

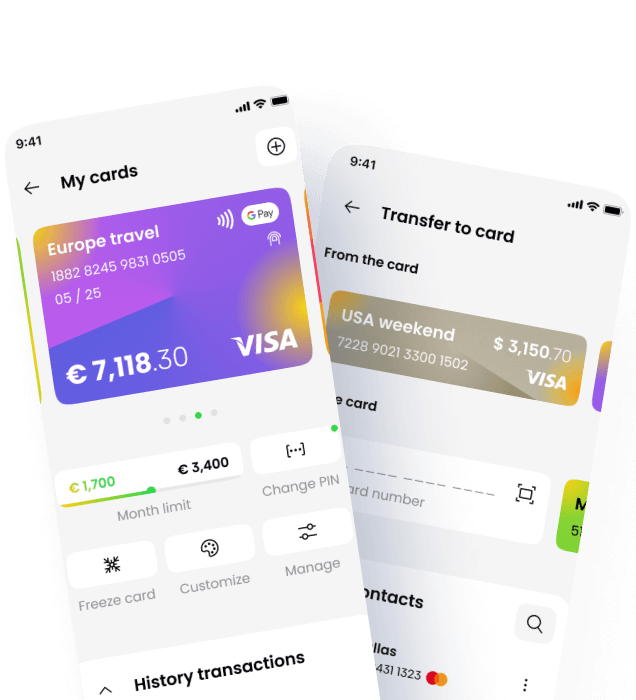

Invest in analytics platforms that can process and visualise large volumes of payment data. Look for tools that offer:

- Real-time dashboards

- Customisable reports

- Predictive analytics

Payments in the Channel offer built-in analytics tools that help businesses monitor revenue, churn, and customer behaviour.

2. Personalisation

Use payment data to personalise the customer experience:

- Recommend products based on past purchases

- Offer discounts to high-value customers

- Send reminders for expiring subscriptions or abandoned carts

Netflix uses payment and viewing data to recommend content, increasing engagement and reducing churn.

3. Risk Management

Payment data can help assess and manage financial and operational risk:

- Identify high-risk customers or geographies

- Monitor refund and chargeback rates

- Forecast cash flow based on recurring payment trends

Advanced platforms use AI to score transactions in real-time, helping businesses make smarter decisions about approvals and declines.

Real-World Examples

Netflix

Netflix uses payment data not only to manage subscriptions but also to understand user preferences. This data feeds into their recommendation engine, which is responsible for over 80% of the content watched on the platform.

PayPal

PayPal processes over 40 million transactions per day. Its fraud detection system uses real-time payment data and machine learning to identify and block suspicious activity, saving billions in potential losses.

Shopify

Shopify merchants use payment data to track sales trends, identify top-performing products, and optimise marketing campaigns—all from a centralised dashboard.

The Future of Payment Data

As technology continues to evolve, the potential uses for payment data will only grow. Key trends include:

- AI and Machine Learning: More sophisticated models will uncover deeper insights and automate decision-making.

- Real-Time Analytics: Businesses will move from monthly reports to real-time dashboards that drive instant action.

- Data Privacy and Compliance: With regulations like GDPR and CCPA, businesses must balance data utility with privacy and security.

Businesses must ensure that all data usage complies with relevant laws and that customer data is stored and processed securely.

Conclusion

Data is the new currency—and payment data is one of the most valuable forms of it. By leveraging payment data, businesses can gain insights into customer behavior, detect and prevent fraud, and improve operational efficiency.

At Payments in the Channel, we’re committed to helping businesses unlock the value of their payment data and stay ahead of the curve. Whether you’re a SaaS provider, fintech platform, or e-commerce business, the right data strategy can transform your payments from a backend function into a strategic growth driver.

🔗 Learn more at (https://www.paymentsinthechannel.com)