Fraudsters are no longer lone hackers operating in the shadows—they’re organized, AI-powered, and fast. As digital payments become more seamless and real-time, so too do the threats that accompany them. Businesses must evolve their defences to stay ahead of increasingly sophisticated fraud tactics.In this blog, we explore the emerging threats in payment fraud, the technologies …

Payments in the Channel

Fraudsters are no longer lone hackers operating in the shadows—they’re organized, AI-powered, and fast. As digital payments become more seamless and real-time, so too do the threats that accompany them. Businesses must evolve their defences to stay ahead of increasingly sophisticated fraud tactics.

In this blog, we explore the emerging threats in payment fraud, the technologies reshaping fraud prevention, and how businesses can build a proactive, intelligent defence strategy.

Emerging Threats in Modern Fraud

Synthetic Identities

Fraudsters now create fake personas using a mix of real and fabricated data—like combining a legitimate social security number with a false name and address. These synthetic identities can pass basic verification checks and are used to open accounts, build credit, and eventually commit fraud.

According to the Federal Reserve, synthetic identity fraud is the fastest-growing type of financial crime in the U.S., costing lenders billions annually.

Deepfakes

AI-generated voice and video impersonations are being used to trick businesses and individuals. Fraudsters can now mimic a CEO’s voice to authorize a wire transfer or create a fake video call to bypass identity verification.

⚠️ In 2023, a UK-based company lost over $240,000 after a fraudster used a deepfake voice to impersonate its CEO in a phone call.

Real-Time Fraud

With the rise of instant payments, fraudsters exploit the speed of transactions to move stolen funds before detection systems can react. Traditional batch-based fraud detection is no longer sufficient.

How to Fight Back

To combat these evolving threats, businesses must adopt equally advanced tools and strategies.

AI & Machine Learning

AI can analyse vast amounts of transaction data in real-time, identifying patterns and anomalies that humans would miss. Machine learning models continuously improve as they process more data, adapting to new fraud tactics.

Behavioural Biometrics

Instead of relying solely on static data (like passwords or card numbers), behavioral biometrics analyse how users interact with devices—how they type, swipe, or move their mouse. These subtle patterns are difficult for fraudsters to replicate.

Real-Time Risk Scoring

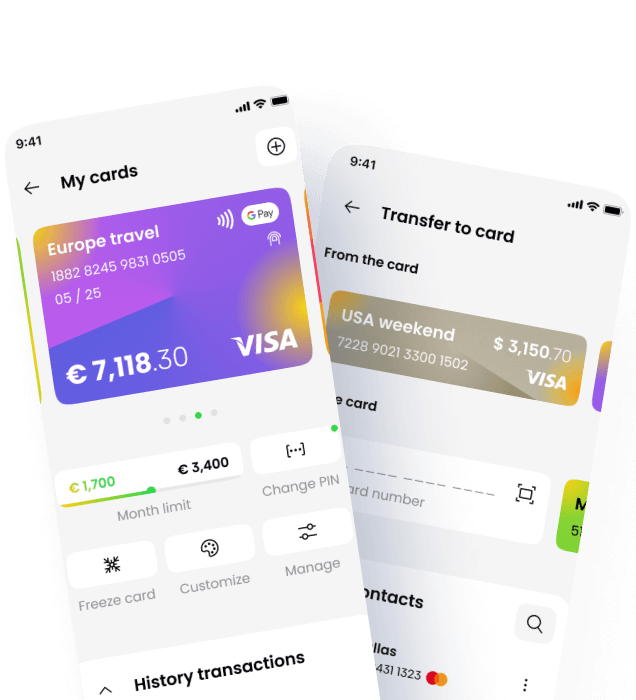

Modern fraud prevention systems assign a risk score to each transaction in real-time. High-risk transactions can be flagged, delayed, or blocked automatically, while low-risk ones proceed without friction.

Example: Stripe Radar and NMI’s fraud tools use real-time scoring to detect and block suspicious activity before it causes damage.

The Evolution of Fraud

Fraud has evolved from simple phishing scams to complex, multi-layered attacks powered by automation and AI. Today’s fraudsters operate like startups—testing, iterating, and scaling their attacks.

- Then: Stolen credit card numbers sold on the dark web.

- Now: AI-generated identities, deepfake impersonations, and real-time social engineering.

This evolution demands a shift in mindset: from reactive fraud detection to proactive fraud prevention.

The Impact of Synthetic Identities

Synthetic identity fraud is particularly dangerous because it can go undetected for months or even years. Fraudsters build up credit histories with fake identities, then “bust out” by maxing out credit lines and disappearing.

How to Detect It:

- Use identity verification tools that cross-check multiple data points (e.g., phone, email, IP address).

- Monitor for unusual account behavior, such as rapid credit usage or inconsistent login patterns.

- Leverage consortium data—shared fraud intelligence across platforms—to identify known synthetic profiles.

The Role of Deepfakes in Payment Fraud

Deepfakes are no longer just a novelty—they’re a real threat to financial security. Fraudsters can use AI-generated audio or video to:

- Trick employees into authorising payments

- Bypass biometric verification systems

- Impersonate executives or customers

Defense Strategies:

- Implement multi-factor authentication (MFA) that includes device and location checks.

- Train employees to verify unusual requests through secondary channels.

- Use liveness detection in biometric systems to distinguish real users from deepfakes.

The Importance of Real-Time Risk Scoring

Real-time risk scoring is essential in a world of instant payments. It allows businesses to:

- Evaluate each transaction based on dozens of risk signals

- Automatically approve, flag, or block transactions

- Reduce false positives and improve customer experience

Businesses using real-time fraud scoring report up to 60% fewer chargebacks and a 30% reduction in manual reviews.

The Future of Fraud Prevention

The future of fraud prevention lies in intelligent, adaptive systems that learn and evolve. Key trends include:

- Federated Learning: Sharing fraud insights across platforms without compromising user privacy.

- Explainable AI: Making AI decisions transparent so fraud analysts can understand and trust the system.

- Embedded Fraud Tools: Integrating fraud prevention directly into payment gateways, CRMs, and SaaS platforms.

As fraudsters become more sophisticated, so must your defences. The goal is not just to stop fraud—but to do so without disrupting legitimate customers.

Conclusion

Fraud is evolving. So must your defences.

Today’s fraudsters are fast, organised, and AI-powered. Businesses that rely on outdated tools or manual reviews are at risk of falling behind. By embracing AI, behavioural biometrics, and real-time risk scoring, you can stay one step ahead.

At Payments in the Channel, we help businesses implement modern fraud prevention strategies that protect revenue without adding friction. Whether you’re a SaaS provider, fintech platform, or e-commerce business, we can help you build a smarter, safer payment experience.

🔗 Learn more at (https://www.paymentsinthechannel.com)