In the world of payments, the best experience is often the one you don’t even notice. Frictionless payments are becoming the gold standard, offering seamless transactions that enhance customer satisfaction and drive business growth. As digital commerce continues to evolve, businesses that prioritise ease and speed at checkout are gaining a competitive edge.In this blog, …

Frictionless is the Future: Why Seamless Payments Are the New Standard

Payments in the Channel

In the world of payments, the best experience is often the one you don’t even notice. Frictionless payments are becoming the gold standard, offering seamless transactions that enhance customer satisfaction and drive business growth. As digital commerce continues to evolve, businesses that prioritise ease and speed at checkout are gaining a competitive edge.

In this blog, we’ll explore what frictionless payments are, why they matter, and how businesses can implement them effectively.

What Are Frictionless Payments?

Frictionless payments are transactions that occur with minimal effort from the customer. This means:

- No redirects to third-party sites

- No re-entering of payment details

- No unnecessary steps or delays

The goal is to make the payment process as smooth and invisible as possible—so customers can focus on what they’re buying, not how they’re paying.

According to Baymard Institute, the average cart abandonment rate is nearly 70%, and a significant portion of that is due to friction in the checkout process.

The Importance of Frictionless Payments

1. Enhanced Customer Experience

A smooth payment process leads to a better overall customer experience. When customers don’t have to think about the payment, they can focus on the product or service they’re purchasing. This leads to:

- Higher satisfaction

- Increased trust

- More repeat purchases

2. Increased Conversion Rates

Every extra step in the checkout process increases the chance of abandonment. Frictionless payments reduce these steps, leading to:

- Lower cart abandonment

- Higher conversion rates

- Faster checkout times

Shopify reports that stores using Shop Pay (a frictionless checkout option) see conversion rates up to 1.72x higher than regular checkouts.

3. Competitive Advantage

In a crowded market, offering a superior payment experience can set a business apart. Frictionless payments can be a key differentiator that attracts and retains customers—especially in industries like SaaS, e-commerce, and digital services.

How to Implement Frictionless Payments

1. Tokenisation

Tokenisation replaces sensitive payment information (like credit card numbers) with a unique identifier or “token.” This allows for:

- One-click payments

- Secure storage of payment details

- Reduced PCI compliance burden

Tokenisation is a foundational technology for enabling secure, frictionless repeat purchases.

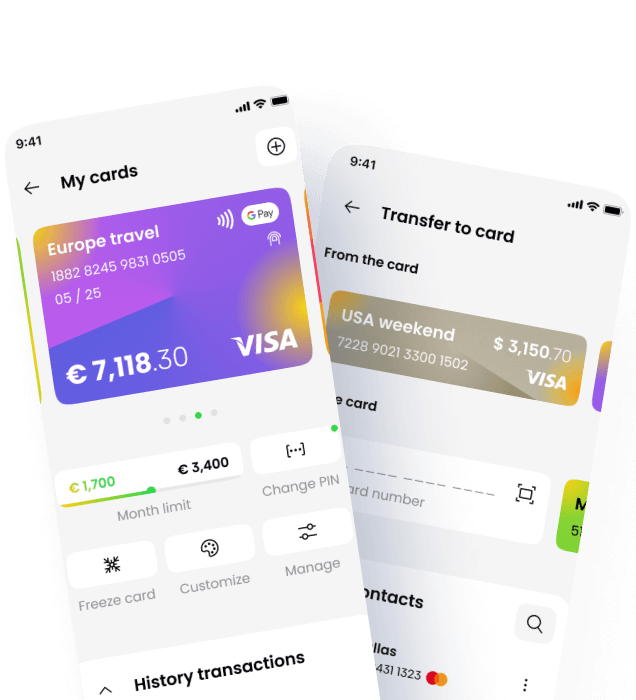

2. Mobile Wallets

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay offer a frictionless payment experience by allowing customers to pay with a simple tap or scan. Benefits include:

- Biometric authentication (fingerprint or face ID)

- No need to enter card details

- Fast, secure transactions

3. Biometric Authentication

Biometric authentication adds an extra layer of security without adding friction. Customers can authenticate payments quickly and easily using:

- Fingerprint recognition

- Facial recognition

- Voice authentication

Biometric payments are expected to exceed $3 trillion globally by 2025, according to Juniper Research.

4. Seamless Integration

Ensure that your payment gateway integrates seamlessly with your website or app. This means:

- No redirects to external sites

- Consistent branding throughout the checkout process

- Optimised performance across devices

Real-World Examples

Amazon – 1-Click Ordering

Amazon’s 1-Click ordering is a prime example of frictionless payments. Customers can complete a purchase with a single click, without having to enter payment or shipping information. This innovation has been credited with significantly boosting Amazon’s sales.

Uber – Invisible Payments

Uber’s payment process is entirely frictionless. Customers simply get in and out of the car, and the payment is handled automatically in the background. This invisible payment model has become a benchmark for user experience in the gig economy.

The Future of Frictionless Payments

The future of frictionless payments lies in further integration with emerging technologies:

- Internet of Things (IoT): Smart devices like refrigerators, cars, and wearables will initiate and complete payments autonomously.

- Voice Commerce: Voice assistants like Alexa and Google Assistant will enable hands-free purchases.

- Contextual Payments: Payments will be embedded into experiences—like buying a product directly from a livestream or social media post.

As payments become more embedded and invisible, businesses must ensure that security, compliance, and user trust remain top priorities.

Conclusion

Frictionless payments are not just a trend—they’re the future of commerce. By removing barriers and making transactions seamless, businesses can:

- Enhance customer satisfaction

- Increase conversion rates

- Gain a competitive edge

At Payments in the Channel, we’re committed to helping businesses implement frictionless payment solutions that drive growth and success. Whether you’re a SaaS provider, e-commerce brand, or digital platform, now is the time to invest in a payment experience your customers won’t even notice—but will always appreciate.

🔗 Learn more at (https://www.paymentsinthechannel.com)