Independent Software Vendors (ISVs) often view payment processing as a necessary but costly part of their business. However, with the right strategies, ISVs can transform payments from a cost center into a profit center. This blog explores how ISVs can leverage payment processing to drive revenue and growth.The Traditional View of PaymentsFor many ISVs, payment …

ISVs: Turn Payments from a Cost Center to a Profit Center

Payments in the Channel

Independent Software Vendors (ISVs) often view payment processing as a necessary but costly part of their business. However, with the right strategies, ISVs can transform payments from a cost center into a profit center. This blog explores how ISVs can leverage payment processing to drive revenue and growth.

The Traditional View of Payments

For many ISVs, payment processing is seen as a cost center due to:

- Transaction Fees: Payment gateways and processors charge fees for each transaction, which can add up over time.

- Compliance Costs: Ensuring compliance with payment regulations and standards requires time and resources.

- Fraud Prevention: Implementing fraud prevention measures adds to the overall cost of payment processing.

Industry Insights

According to a report by McKinsey, payment processing costs can account for up to 2–3% of a company’s revenue. For ISVs operating on thin margins, these costs can significantly impact profitability.

Turning Payments into a Profit Center

By adopting the following strategies, ISVs can turn payments into a revenue-generating opportunity:

1. Offer Value-Added Services

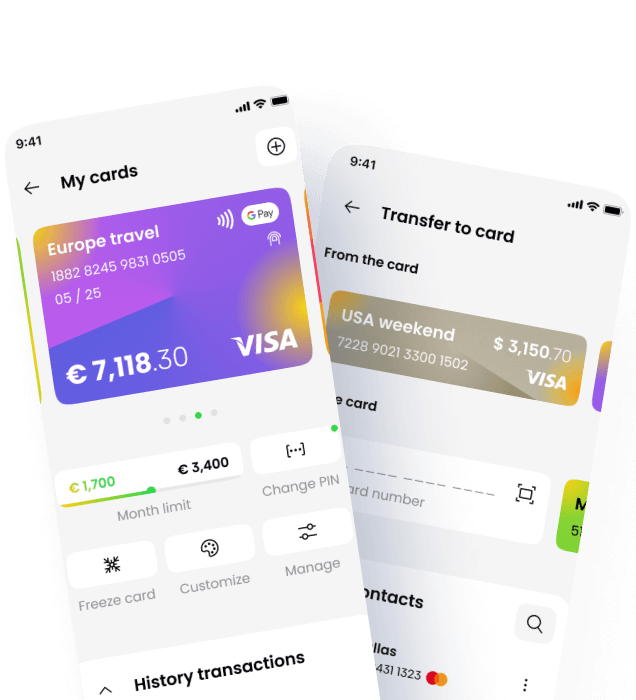

- Integrated Payments: Embed payment processing directly into your software to provide a seamless experience for users. This can increase customer satisfaction and retention.

- Subscription Billing: Offer subscription billing and management services to help customers automate recurring payments and reduce churn.

- Fraud Prevention: Provide advanced fraud detection and prevention tools as part of your software package, adding value for customers.

Case Study: Shopify

Shopify offers integrated payment processing through Shopify Payments. By embedding payments directly into their platform, they provide a seamless experience for merchants and earn additional revenue from transaction fees.

2. Negotiate Better Rates

- Volume Discounts: Negotiate lower transaction fees with payment processors based on your transaction volume. Higher volumes can lead to better rates.

- Bundled Services: Bundle payment processing with other services to create a comprehensive solution that justifies higher pricing.

Example: Toast

Toast, a restaurant management platform, negotiates volume discounts with payment processors and bundles payment processing with their software, creating a compelling value proposition for their customers.

3. Monetise Payment Data

- Analytics and Insights: Offer analytics and insights based on payment data to help customers make informed business decisions. This can be a valuable add-on service.

- Benchmarking: Provide benchmarking data to customers, allowing them to compare their performance against industry standards.

Insight: Square

Square provides detailed analytics and insights to their merchants, helping them understand sales trends, customer behaviour, and more. This data-driven approach adds significant value to their payment processing services.

Partner with Payment Providers

- Revenue Sharing: Partner with payment providers that offer revenue-sharing models. This allows you to earn a percentage of the transaction fees.

- Referral Programs: Participate in referral programs where you earn commissions for referring customers to payment providers.

Example: Payments in the Channel

Payments in the Channel offers revenue-sharing models for ISVs, allowing them to earn a percentage of transaction fees. This partnership approach turns payment processing into a profit center for ISVs.

5. Enhance Customer Experience

- Seamless Onboarding: Simplify the onboarding process for new customers, making it easy for them to start accepting payments.

- Customer Support: Provide excellent customer support to address payment-related issues and build trust with your customers.

Best Practice: Stripe

Stripe is known for its seamless onboarding process and excellent customer support. By making it easy for businesses to start accepting payments and providing top-notch support, Stripe enhances the overall customer experience.

Case Study: NMI

NMI is a leading payment gateway that offers a range of solutions for ISVs. By partnering with NMI, ISVs can access advanced payment processing features, including:

- Integrated Payments: Seamlessly embed payment processing into your software.

- Subscription Billing: Automate recurring payments and reduce churn.

- Fraud Prevention: Implement advanced fraud detection and prevention tools.

- Revenue Sharing: Benefit from revenue-sharing models to generate additional income.

Conclusion

Payment processing doesn’t have to be a cost center for ISVs. By offering value-added services, negotiating better rates, monetising payment data, partnering with payment providers, and enhancing customer experience, ISVs can turn payments into a profit center.

Implement these strategies to unlock new revenue opportunities and drive growth for your business.

🔗 Learn more at (https://www.paymentsinthechannel.com)