Recurring payments are a cornerstone of the subscription economy, providing businesses with a steady stream of revenue. However, managing recurring payments can be challenging, with risks such as payment failures, churn, and fraud. This blog explores strategies to make recurring payments profitable and risk-free.The Importance of Recurring PaymentsRecurring payments offer several benefits for businesses:Industry InsightsAccording …

Make Recurring Payments Profitable & Risk-Free

Payments in the Channel

Recurring payments are a cornerstone of the subscription economy, providing businesses with a steady stream of revenue. However, managing recurring payments can be challenging, with risks such as payment failures, churn, and fraud. This blog explores strategies to make recurring payments profitable and risk-free.

The Importance of Recurring Payments

Recurring payments offer several benefits for businesses:

- Predictable Revenue: Steady cash flow from subscription payments helps businesses plan and grow.

- Customer Retention: Subscriptions create long-term relationships with customers, increasing lifetime value.

- Operational Efficiency: Automated billing reduces the need for manual invoicing and payment collection.

Industry Insights

According to a report by Zuora, subscription businesses grew revenues about 5 times faster than S&P 500 company revenues (18.2% versus 3.6%) over the past decade. This highlights the immense potential of recurring revenue models in driving business growth.

Common Challenges

Despite their benefits, recurring payments come with challenges:

- Payment Failures: Expired cards, insufficient funds, and technical issues can lead to payment failures.

- Churn: Customers may cancel subscriptions due to dissatisfaction, financial constraints, or other reasons.

- Fraud: Recurring payments can be targeted by fraudsters, leading to chargebacks and financial losses.

Real-World Data

A study by Recurly found that the average monthly churn rate for subscription businesses is 5.6%. Additionally, payment failures account for up to 48% of involuntary churn, making it a critical area to address.

Strategies for Success

To make recurring payments profitable and risk-free, businesses can implement the following strategies:

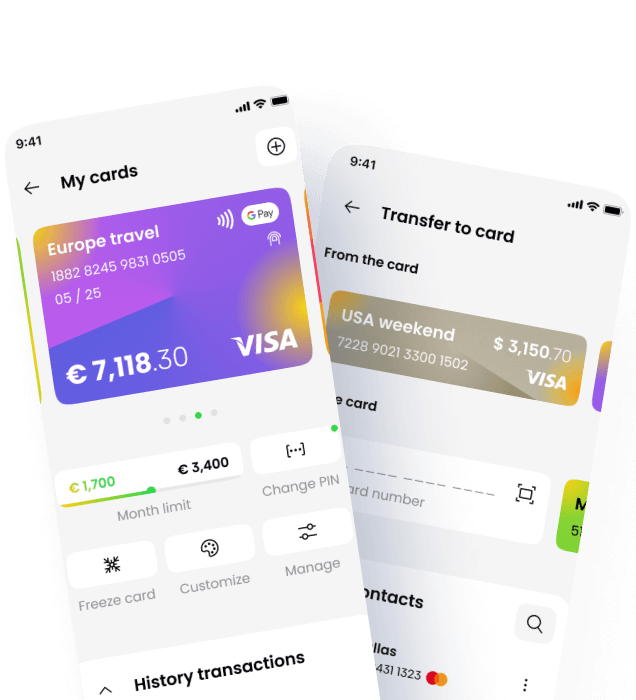

1. Optimise Payment Processing

- Use a Reliable Payment Gateway: Choose a payment gateway with high uptime and robust security features.

- Implement Account Updater Services: Automatically update expired or replaced card information to reduce payment failures.

- Retry Logic: Implement intelligent retry logic to handle temporary payment failures and increase success rates.

Case Study: Netflix

Netflix uses advanced retry logic and account updater services to minimise payment failures. By doing so, they ensure a seamless viewing experience for their subscribers and maintain a high retention rate.

2. Enhance Customer Experience

- Transparent Billing: Clearly communicate billing terms and provide detailed invoices to build trust.

- Flexible Payment Options: Offer multiple payment methods and billing frequencies to accommodate customer preferences.

- Proactive Communication: Notify customers of upcoming payments, expiring cards, and failed transactions to reduce churn.

Example: Spotify

Spotify offers flexible payment options, including monthly and annual subscriptions, and accepts various payment methods such as credit cards, PayPal, and mobile payments. This flexibility caters to a diverse customer base and enhances user satisfaction.

3. Mitigate Fraud

- Fraud Detection Tools: Use advanced fraud detection tools to identify and prevent suspicious transactions.

- Tokenisation: Replace sensitive payment information with tokens to enhance security.

- Chargeback Management: Implement a robust chargeback management process to handle disputes and reduce financial losses.

Insight: Stripe Radar

Stripe Radar leverages machine learning to detect and prevent fraud in real-time. By analysing vast amounts of data, it can identify patterns and flag potentially fraudulent transactions, protecting businesses from financial losses.

4. Monitor and Analyse Performance

- Track Key Metrics: Monitor metrics such as churn rate, payment success rate, and customer lifetime value to identify areas for improvement.

- Customer Feedback: Collect and analyse customer feedback to understand pain points and enhance the subscription experience.

- Continuous Improvement: Regularly review and optimise billing processes to ensure efficiency and effectiveness.

Best Practice: Adobe Creative Cloud

Adobe Creative Cloud tracks key performance metrics and gathers customer feedback to continuously improve its subscription service. This data-driven approach helps them identify and address issues promptly, ensuring a positive user experience.

Conclusion

Recurring payments are a valuable revenue stream for businesses, but they come with challenges that need to be addressed. By optimising payment processing, enhancing customer experience, mitigating fraud, and monitoring performance, businesses can make recurring payments profitable and risk-free.

Implement these strategies to unlock the full potential of your subscription model and drive long-term success.

🔗 Learn more at (https://www.paymentsinthechannel.com)