As businesses expand across borders, one of the most critical decisions they face is how to manage payments in international markets. Two models dominate the conversation: Merchant of Record (MoR) and Local Acquiring. Each offers distinct advantages—and potential pitfalls—depending on your business model, risk appetite, and growth strategy. In this blog, we’ll break down what …

Merchant of Record vs. Local Acquiring: Choosing the Right Model for Global Payments

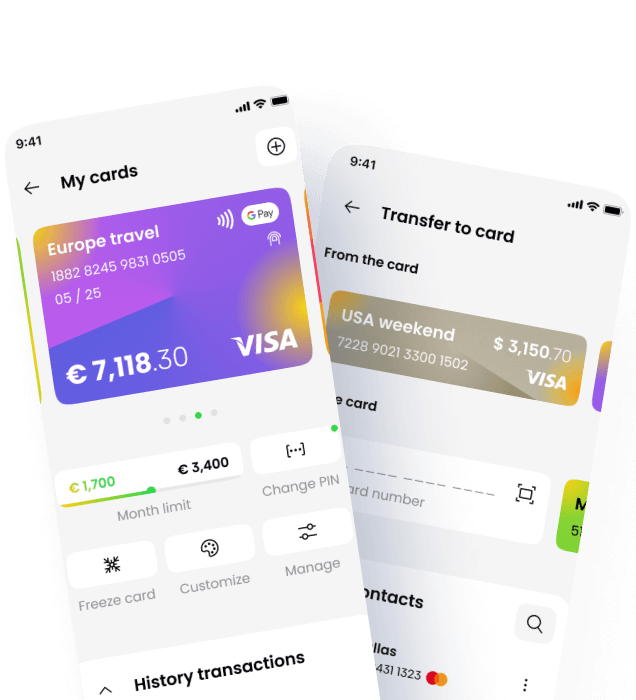

Payments in the Channel

As businesses expand across borders, one of the most critical decisions they face is how to manage payments in international markets. Two models dominate the conversation: Merchant of Record (MoR) and Local Acquiring. Each offers distinct advantages—and potential pitfalls—depending on your business model, risk appetite, and growth strategy.

In this blog, we’ll break down what each model entails, explore their pros and cons, and help you determine which approach is best suited for your global ambitions.

Understanding the Basics

What is a Merchant of Record (MoR)?

A Merchant of Record is the legal entity responsible for processing customer payments. This entity:

- Holds the merchant account

- Handles payment processing

- Manages compliance (e.g., PCI-DSS)

- Collects and remits taxes

- Bears the risk of chargebacks and fraud

When you use an MoR provider, they effectively “resell” your product or service to the end customer. You get paid by the MoR, not the customer directly.

.

What is Local Acquiring?

Local acquiring refers to working with acquiring banks or payment processors in each country or region where you operate. You remain the merchant of record and:

- Open local merchant accounts

- Integrate with local payment gateways

- Handle compliance and tax obligations

- Manage fraud and chargebacks internally

This model gives you more control—but also more responsibility.

The Pros and Cons of Each Model

✅ Merchant of Record: Pros

- Simplified Compliance

- The MoR handles PCI compliance, tax collection, and regulatory requirements.

- Ideal for businesses entering multiple markets quickly.

- Faster Market Entry

- No need to set up local entities or banking relationships.

- Launch in new countries in weeks, not months.

- Reduced Operational Overhead

- MoR providers manage fraud, chargebacks, and reconciliation.

- Your team can focus on product and growth.

- Bundled Services

- Many MoRs offer bundled services like tax automation, currency conversion, and customer support.

❌ Merchant of Record: Cons

- Lower Margins

- MoRs charge a premium—often 3–10% of transaction value.

- You may lose pricing flexibility.

- Limited Control

- You don’t own the customer relationship at the payment level.

- Refunds, disputes, and reporting are handled externally.

- Brand Dilution

- Customers may see the MoR’s name on their bank statement.

- This can lead to confusion or mistrust.

- Vendor Lock-In

- Switching MoRs can be complex and disruptive.

- You’re tied to their roadmap and limitations.

✅ Local Acquiring: Pros

- Full Control

- You own the entire payment flow, from checkout to settlement.

- Customize fraud rules, routing logic, and reporting.

- Better Margins

- Lower processing fees compared to MoR models.

- Greater flexibility in pricing and promotions.

- Improved Customer Experience

- Local payment methods and currencies.

- Your brand appears on statements and receipts.

- Data Ownership

- Access to granular transaction data for analytics and optimization.

❌ Local Acquiring: Cons

- Complex Setup

- Requires local entities, bank accounts, and legal infrastructure.

- Can take months to establish in each market.

- Regulatory Burden

- You’re responsible for tax compliance, data protection, and financial reporting.

- Risk of fines or penalties if mishandled.

- Higher Operational Costs

- Need for in-house compliance, finance, and fraud teams.

- Ongoing maintenance of multiple integrations.

- Scalability Challenges

- Managing dozens of local acquirers becomes unwieldy at scale.

- Difficult to maintain consistency across markets.

Real-World Use Cases

When to Choose Merchant of Record

- SaaS startups expanding globally without legal entities abroad.

- Marketplaces that need to onboard sellers quickly and compliantly.

- Digital goods platforms that want to avoid tax complexity (e.g., VAT, GST).

When to Choose Local Acquiring

- Established retailers with local teams and infrastructure.

- Subscription businesses that need full control over billing and churn.

- High-volume merchants optimising for cost and conversion.

Strategic Considerations

1. Speed vs. Control

MoR is ideal for speed and simplicity. Local acquiring is better for control and customisation. Your choice depends on your growth stage and internal capabilities.

2. Cost vs. Risk

MoR reduces risk but increases cost. Local acquiring lowers cost but increases exposure to fraud, chargebacks, and compliance issues.

3. Customer Experience

Local acquiring often delivers a more seamless, localised experience. MoR can introduce friction if not well-integrated.

4. Hybrid Models

Some businesses use a hybrid approach—starting with MoR to enter new markets, then transitioning to local acquiring as they scale.

The Payments in the Channel Perspective

At Payments in the Channel, we help businesses navigate this critical decision with clarity and confidence. Whether you’re launching in Europe, expanding into Asia, or optimising your U.S. operations, we offer tailored solutions that align with your goals.

We also partner with platforms that support both models—so you can start with MoR and graduate to local acquiring when the time is right.

Choosing between Merchant of Record and Local Acquiring isn’t just a technical decision—it’s a strategic one. It affects your margins, compliance posture, customer experience, and ability to scale.

By understanding the trade-offs and aligning your payment strategy with your business model, you can unlock new markets, reduce friction, and drive sustainable growth.