In today’s digital-first economy, online payment processing is no longer a luxury—it’s a necessity. Whether you're a small business owner launching your first e-commerce store or a seasoned enterprise expanding into new markets, understanding how online payments work is essential to delivering a seamless customer experience and ensuring secure, efficient transactions.This guide breaks down the …

Online Payment Processing 101: A Complete Guide for Businesses

Payments in the Channel

In today’s digital-first economy, online payment processing is no longer a luxury—it’s a necessity. Whether you’re a small business owner launching your first e-commerce store or a seasoned enterprise expanding into new markets, understanding how online payments work is essential to delivering a seamless customer experience and ensuring secure, efficient transactions.

This guide breaks down the fundamentals of online payment processing, explains the key players involved, and offers practical advice on choosing the right solutions for your business.

What Is Online Payment Processing?

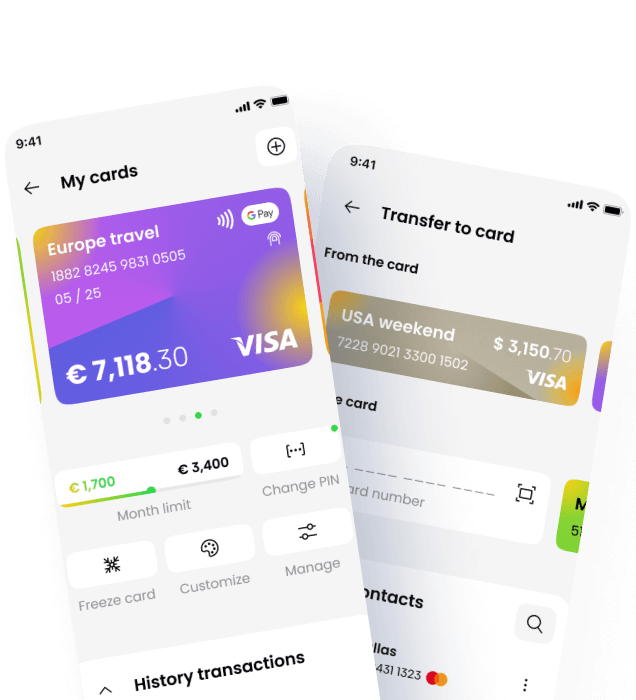

Online payment processing refers to the series of steps that occur when a customer makes a purchase on a website or app using a digital payment method—such as a credit card, debit card, digital wallet, or bank transfer. While the process may seem instantaneous to the user, it involves a complex network of systems working together to authorise, authenticate, and settle the transaction.

The Core Steps of Online Payment Processing

- Customer Checkout

The process begins when a customer enters their payment details at checkout. - Authorisation

The payment gateway sends the transaction request to the acquiring bank, which forwards it to the card network (e.g., Visa, Mastercard). The card network then contacts the issuing bank (the customer’s bank) to verify the transaction. - Authentication

The issuing bank checks for sufficient funds and verifies the customer’s identity using fraud detection tools and, increasingly, two-factor authentication (e.g., 3D Secure). - Approval or Decline

The issuing bank either approves or declines the transaction and sends the response back through the network to the merchant. - Settlement

If approved, the transaction is batched and settled—meaning the funds are transferred from the customer’s bank to the merchant’s account, typically within 1–3 business days.

Who Are the Key Players in Online Payments?

Understanding the ecosystem of online payments is crucial for selecting the right partners and ensuring smooth operations. Here are the main entities involved:

- Merchant: The business selling goods or services online.

- Customer: The individual making the purchase.

- Payment Gateway: A service that securely transmits payment data from the customer to the acquiring bank.

- Acquiring Bank (Acquirer): The financial institution that processes payments on behalf of the merchant.

- Issuing Bank (Issuer): The customer’s bank that issued their credit or debit card.

- Card Networks: Companies like Visa, Mastercard, American Express, and Discover that facilitate communication between banks.

- Payment Processor: A third-party service that handles the technical aspects of the transaction, often bundled with the gateway.

Types of Online Payment Methods

Modern consumers expect a variety of payment options. Here are the most common types:

- Credit and Debit Cards: Still the most widely used method globally.

- Digital Wallets: Services like Apple Pay, Google Pay, and PayPal offer fast, secure payments.

- Bank Transfers: Direct payments from a customer’s bank account, often used in B2B transactions.

- Buy Now, Pay Later (BNPL): Services like Klarna and Afterpay allow customers to split payments over time.

- Cryptocurrency: An emerging option for niche markets, though still limited in mainstream adoption.

What Are Real-Time Payments (RTP)?

Real-Time Payments are transactions that are initiated, cleared, and settled within seconds, 24/7. Unlike traditional card payments that may take days to settle, RTP systems—such as the UK’s Faster Payments or the EU’s SEPA Instant Credit Transfer—offer immediate fund availability.

Benefits of RTP:

- Instant confirmation and settlement

- Improved cash flow for merchants

- Enhanced customer experience

- Reduced risk of chargebacks

RTP is especially valuable in sectors like gig economy platforms, peer-to-peer marketplaces, and emergency services.

How to Choose the Right Payment Gateway

Your payment gateway is the bridge between your website and the financial institutions that process payments. Choosing the right one can significantly impact your conversion rates, customer trust, and operational efficiency.

Key Factors to Consider:

- Security & Compliance

Look for PCI DSS compliance, tokenisation, and fraud detection tools. - Integration & Compatibility

Ensure the gateway integrates smoothly with your e-commerce platform (e.g., Shopify, WooCommerce, Magento) and supports APIs for custom development. - Fees & Pricing Structure

Understand the transaction fees, monthly charges, and any hidden costs. Some gateways offer flat-rate pricing, while others use interchange-plus models. - Global Reach

If you sell internationally, choose a gateway that supports multiple currencies and local payment methods. - Customer Support

Reliable, 24/7 support can be a lifesaver during technical issues or chargeback disputes.

Security and Fraud Prevention

Security is a top concern for both merchants and customers. A single breach can damage your reputation and result in significant financial loss.

Best Practices for Secure Payment Processing:

- Use HTTPS: Secure your website with SSL encryption.

- PCI Compliance: Ensure your systems meet Payment Card Industry Data Security Standards.

- Tokenisation: Replace sensitive card data with unique tokens.

- 3D Secure 2.0: Add an extra layer of authentication for card payments.

- AI-Based Fraud Detection: Use machine learning tools to detect suspicious activity in real time.

Benefits of Online Payment Processing

Implementing a robust online payment system offers numerous advantages:

- Convenience: Customers can pay anytime, anywhere.

- Speed: Transactions are processed in seconds.

- Scalability: Easily handle high volumes of transactions.

- Customer Trust: Secure, seamless payments build brand credibility.

- Data Insights: Track customer behaviour and optimise sales strategies.

Common Challenges and How to Overcome Them

- High Cart Abandonment Rates

- Solution: Simplify the checkout process and offer multiple payment options.

- Chargebacks and Fraud

- Solution: Use fraud detection tools and clearly communicate refund policies.

- Integration Issues

- Solution: Choose gateways with strong developer support and documentation.

- Regulatory Compliance

- Solution: Stay updated on local and international regulations like PSD2, GDPR, and PCI DSS.

The Future of Online Payments

The payments landscape is evolving rapidly. Here are a few trends to watch:

- Open Banking: Enables direct bank-to-bank payments and personalised financial services.

- AI and Machine Learning: Powering smarter fraud detection and customer insights.

- Voice and Biometric Payments: Offering new ways to authenticate transactions.

- Embedded Finance: Integrating financial services directly into non-financial platforms.

Conclusion

Online payment processing is the backbone of digital commerce. By understanding how it works and choosing the right tools and partners, businesses can offer a secure, efficient, and user-friendly payment experience. Whether you’re just starting out or looking to optimise your current setup, investing in the right payment infrastructure is key to long-term success.

🔗 Learn more at (https://www.paymentsinthechannel.com)