Open Banking is revolutionising the way we manage and access financial data. One of the most exciting developments in this space is the integration of Open Banking with payment terminals, enabling seamless and secure transactions directly from bank accounts.What is Open Banking?Open Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure …

Payments in the Channel

Open Banking is revolutionising the way we manage and access financial data. One of the most exciting developments in this space is the integration of Open Banking with payment terminals, enabling seamless and secure transactions directly from bank accounts.

What is Open Banking?

Open Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure exchange of financial data between banks and third-party providers. This allows customers to share their financial information with authorised providers, leading to enhanced services and improved customer experiences.

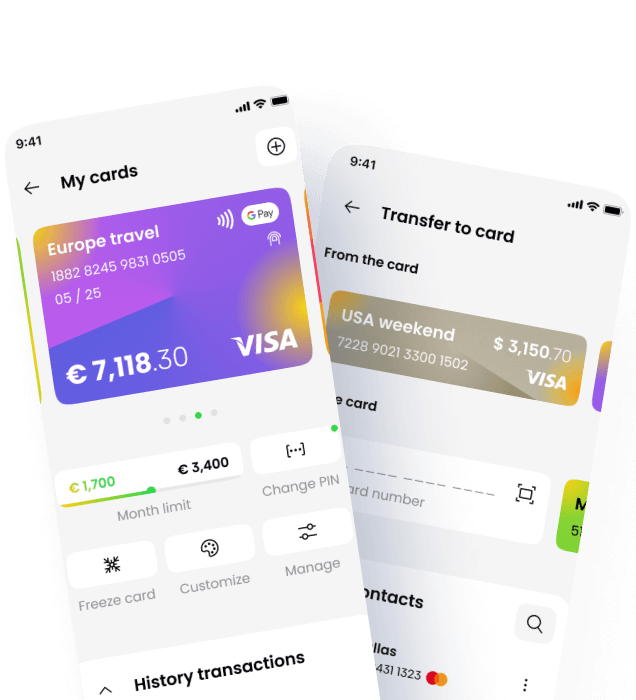

The Role of Payment Terminals

Payment terminals are devices used to process card payments at physical locations, such as retail stores and restaurants. Integrating Open Banking with payment terminals allows customers to make payments directly from their bank accounts using secure APIs, bypassing traditional card networks.

Benefits of Open Banking on Payment Terminals

Integrating Open Banking with payment terminals offers several advantages:

– Seamless Transactions: Customers can make payments directly from their bank accounts, providing a smooth and efficient checkout experience.

– Enhanced Security: Open Banking APIs use robust security measures to protect customer data during transmission and storage.

– Reduced Costs: By bypassing traditional card networks, businesses can reduce transaction fees and improve their bottom line.

– Improved Customer Experience: Customers have greater control over their financial data and can choose the payment method that best suits their needs.

Use Cases

Open Banking on payment terminals has a wide range of applications, including:

– Retail: Customers can make purchases directly from their bank accounts, providing a seamless checkout experience.

– Restaurants: Diners can pay for their meals using Open Banking APIs, reducing wait times and improving service.

– Healthcare: Patients can pay for medical services directly from their bank accounts, streamlining the payment process.

Future Developments

As Open Banking continues to evolve, we can expect to see further integration with payment terminals and other financial services. This will lead to even more seamless and secure transactions, enhancing the overall customer experience.

Conclusion

Open Banking on payment terminals is an exciting development that offers numerous benefits for both customers and businesses. By enabling seamless and secure transactions directly from bank accounts, Open Banking enhances the checkout experience, improves security, and reduces costs. As the industry continues to evolve, Open Banking will play a crucial role in shaping the future of payments.

🔗 Learn more at (https://www.paymentsinthechannel.com)