Open Banking is revolutionising the financial industry by enabling secure and seamless access to financial data. This innovative approach allows customers to share their financial information with third-party providers, leading to enhanced services and improved customer experiences.Understanding Open BankingOpen Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure exchange of financial …

Payments in the Channel

Open Banking is revolutionising the financial industry by enabling secure and seamless access to financial data. This innovative approach allows customers to share their financial information with third-party providers, leading to enhanced services and improved customer experiences.

Understanding Open Banking

Open Banking involves the use of APIs (Application Programming Interfaces) to facilitate the secure exchange of financial data between banks and third-party providers. Key components of Open Banking include:

– APIs: Standardised interfaces that allow different systems to communicate and share data.

– Customer Consent: Customers must provide explicit consent for their data to be shared with third-party providers.

– Security: Robust security measures ensure that data is protected during transmission and storage.

Benefits of Open Banking

Open Banking offers several advantages for both customers and businesses:

– Enhanced Services: Third-party providers can offer personalised financial services based on customer data.

– Improved Transparency: Customers have greater visibility into their financial information and can make more informed decisions.

– Increased Competition: Open Banking fosters competition among financial service providers, leading to better products and services.

Use Cases

Open Banking has a wide range of applications, including:

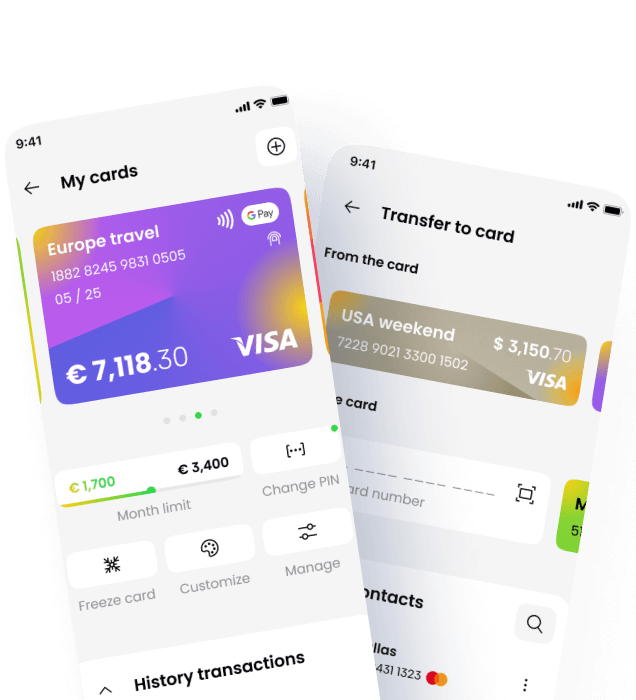

– Personal Finance Management: Apps that aggregate financial data from multiple sources to provide insights and budgeting tools.

– Payment Initiation: Services that enable customers to make payments directly from their bank accounts without using traditional payment methods.

– Credit Scoring: Enhanced credit scoring models that use a broader range of financial data to assess creditworthiness.

Open Banking on Payment Terminals

One exciting development in Open Banking is its integration with payment terminals. This allows customers to make payments directly from their bank accounts using secure APIs, providing a seamless and efficient checkout experience.

Conclusion

Open Banking is transforming the financial industry by enabling secure and seamless access to financial data. By leveraging APIs and customer consent, Open Banking offers enhanced services, improved transparency, and increased competition. As the industry continues to evolve, Open Banking will play a crucial role in shaping the future of financial services.

Talk to us about open Banking and how this can help to support your business.

🔗 Learn more at (https://www.paymentsinthechannel.com)